Free Cash Flow Yield Explained

Essentially, free cash flow is the amount of money. Free cash flow (fcf) is an improved version of net profit (pat).

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

The ratio is calculated by taking.

Free cash flow yield explained. In that case, the free cash flow yield is a yield per share and is determined by dividing the free cash flow per share by the value of that share. It was buffett who made the use of free cash flow popular for stock analysis. We can also compare the fcf yields to bond yields.

“ free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Free cash flow is a. Free cash flow is very close to warren buffett's definition of owner's earnings, except that in warren buffett's owner's earnings, the spending for property, plant, and equipment is only for maintenance (replacement), while in the free cash flow calculation, the cost of new property, plant, and equipment due to business expansion is also deducted.

Free cash flow yield determines if the stock price provides good value for the amount of free cash flow being generated. Free cash flow yield as described by investopedia: Free cash flow (fcf) is the cash flow available for the company to repay creditors or pay dividends and interest to investors.

Free cash flow yield evaluates if the stock price of a company provides good value for the free cash flow being generated. Jan in effect, these are cash cows that have high dividend yields. The result is the same.

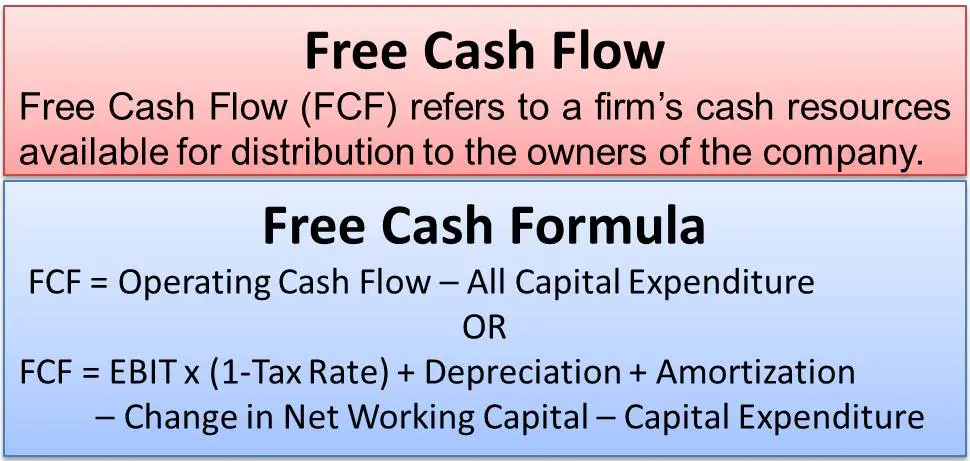

Free cash flow is the cash that a business has available to pay debts, buy assets (such as stock or property), or pay shareholders’ dividends and interest. The ratio is calculated by taking the free cash flow per share divided by the current share price. Free cash flow measures how much cash a company has at its disposal, after covering the costs associated with remaining in business.

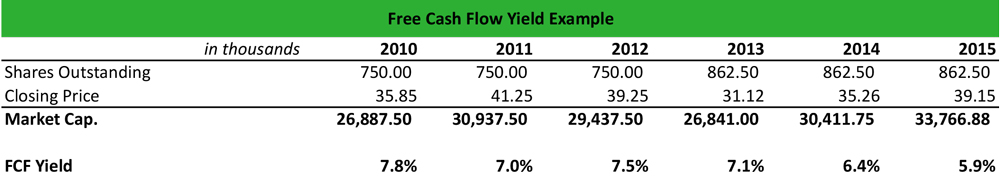

Free cash flow is a great tool to use for case study interviews and for returns analyses. Yields that exceed 7% are considered of high rank. The free cash flow yield cash flow yield the free cash flow yield is a financial ratio that compares the free cash flow per share to the market price per share to determine how much cash flow the company has in the event of liquidation or other obligations.

Fcf yield is the answer: What is easily available in company’s financial statement is pat. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

Free cash flow yield is really just the company’s free cash flow, divided by its market value. The simplest way to calculate free cash flow is to subtract capital expenditures from operating cash flow. The ratio of free cash flow to a company’s enterprise value (fcf/ enterprise value ).

You can hide a lot of things in raw earnings, but cash flow is what it is. It doesn’t include the company’s value towards any ownership rights such as property, stock, equipment, licensing, or patent rights. Analysts may have to do additional or slightly altered calculations depending on the data at their disposal.

Tesla (nas:tsla) free cash flow explanation. Although irr and mom often reign supreme as the most popular private equity return metrics, free cash flow yield is also a very powerful investment metric. Free cash flow yield offers investors or stockholders a better measure of a company’s fundamental performance than the widely used p/e ratio.

To define what levered free cash flow is, it is simply the amount of cash available for either (a) redistribution to shareholders, or (b) to reinvest back into the business. Investors who wish to employ the best fundamental indicator should add free cash flow yield to their repertoire of financial measures. To break it down, free cash flow yield is determined, first, by using a company’s cash flow statement cash flow statement a cash flow statement contains information on how much cash a company generated and used during a given period., subtracting capital expenditures from all.

Free cash flow yield explained. But fcf must be separately calculated by the analyst. The ratio of free cash flow to a company’s enterprise value (fcf/enterprise value).

Free cash flow is very close to warren buffett's definition of owner's earnings, except that in warren buffett's owner's earnings, the spending for property, plant, and equipment is only for maintenance (replacement), while in the free cash flow calculation, the cost of new property, plant, and equipment due to business expansion is also. The free cash flow yield ratio is a good metric because it relies on two figures which are difficult for shady businesses to manipulate. Fcf yield is the answer:

Based on whether an unlevered or levered cash flow metric is used, the free cash flow yield denotes how much cash flow that the represented investor group(s) are collectively entitled to. When researching dividend stocks, usually, yields that are above 4% would be acceptable for further research. What is considered as a good free cash flow?

Warren buffett mentions free cash flow as “owners income”. You should not depend on just one measure, of course. The key to the equation is that this cash is the cash left over after paying.

In general, especially when researching dividend stocks, yields above 4% would be acceptable for further research. Fcf yields > p/e multiples. The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation.

We can also compare the fcf yields to bond yields. And free cash flow can be distributed in the form of carry or dividends,.

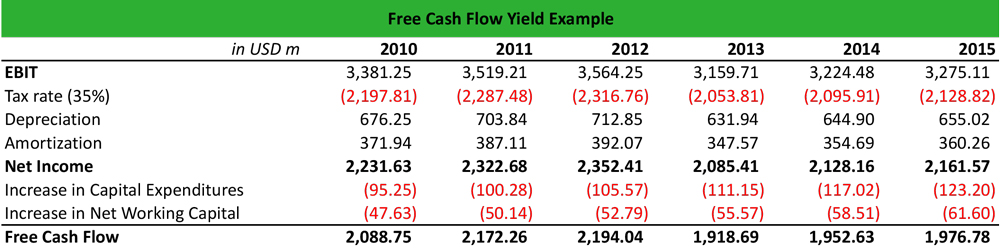

Free Cash Flow Yield Formula Top Example Fcfy Calculation

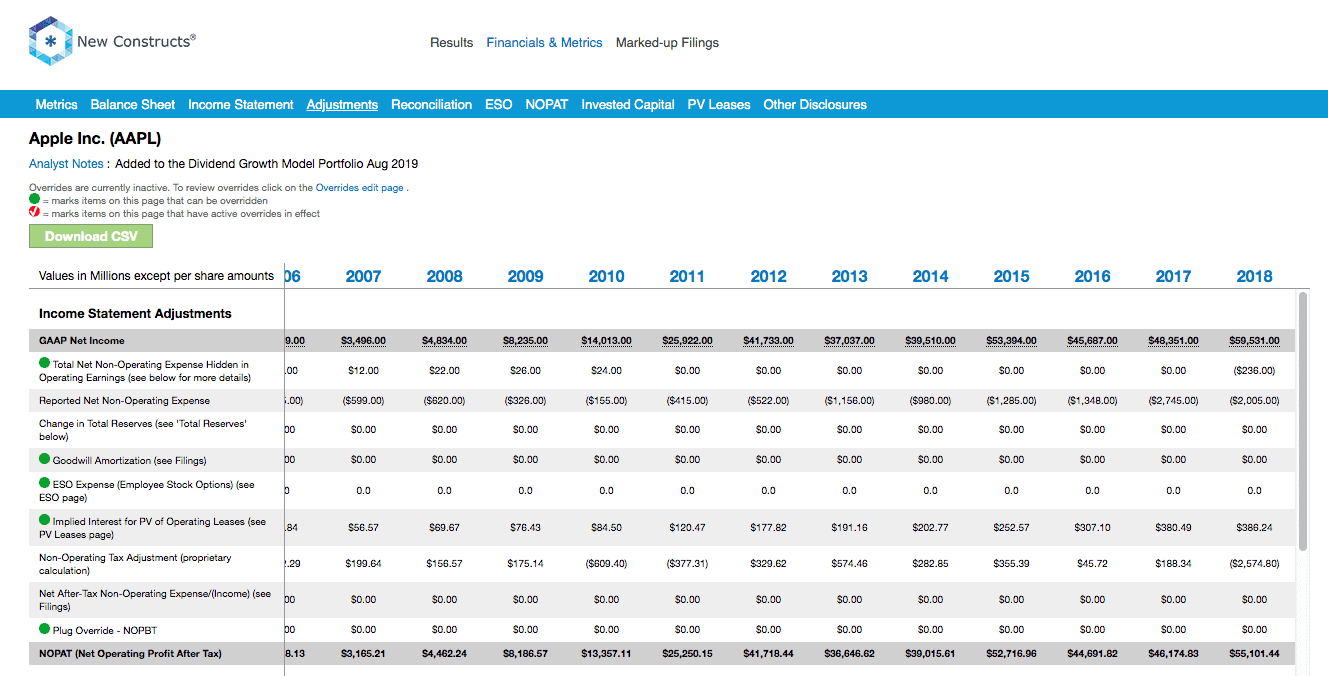

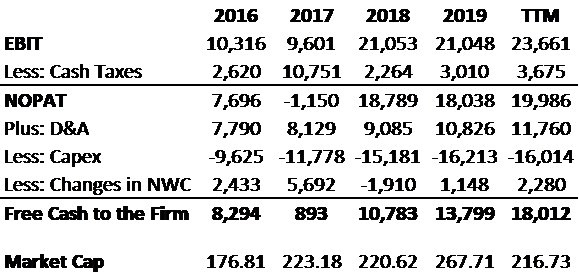

Education Metrics Fcf - New Constructs

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

What Is Free Cash Flow Yield - Definition Meaning Example

Free Cash Flow - Efinancemanagement

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

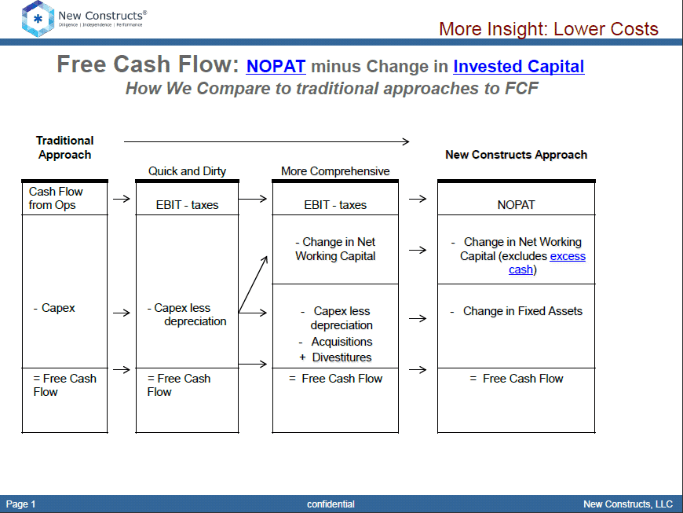

Free Cash Flow And Fcf Yield - New Constructs

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Cash Flow Ratio Analysis Double Entry Bookkeeping

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Free Cash Flow Yield - Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield - Finding Gushing Cash Flow For Future Growth

Free Cash Flow And Fcf Yield - New Constructs

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Yield - Definition Meaning Example

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

You have just read the article entitled Free Cash Flow Yield Explained. You can also bookmark this page with the URL : https://naomijez.blogspot.com/2022/01/free-cash-flow-yield-explained.html

0 Response to "Free Cash Flow Yield Explained"

Post a Comment