Unlevered Free Cash Flow Margin

Portfolio123 data, author screen) this version of the rule of 40 just managed to beat. Apple annual free cash flow for 2020 was $73.365b, a 24.57% increase from 2019.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

A business or asset that generates more cash than it invests provides a positive fcf that may be used to pay interest or retire debt (service debt holders), or to pay dividends or buy back stock (service equity holders).

Unlevered free cash flow margin. Gaap operating margin of 10% and adjusted operating income margin of 39% cash flow from operations of $46.5 million and unlevered free cash flow of $73.3 million vancouver, wash. It is the cash flow available to all equity holders and debtholders after all operating expenses, capital expenditures, and investments in working capital have been made. The unlevered free cash flow margin measures a company’s unlevered free cash flow as a percentage of the revenue.

The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation. Unlevered free cash flow is the cash flow a business has, excluding interest payments. The formula to calculate unlevered free cash flow margin and an example calculation for microsoft’s trailing twelve months is outlined below:

Unlevered free cash flow (aka free cash flow to the firm, ufcf and fcfc for short) refers to a free cash flow available to all investors of a firm including equity and debt holders. Sales growth (ptm/ttm) + unlevered free cash flow profitability (unlevered fcf ttm/sales ttm) >= 40 (source: Apple annual free cash flow for 2021 was $92.953b, a 26.7% increase from 2020.

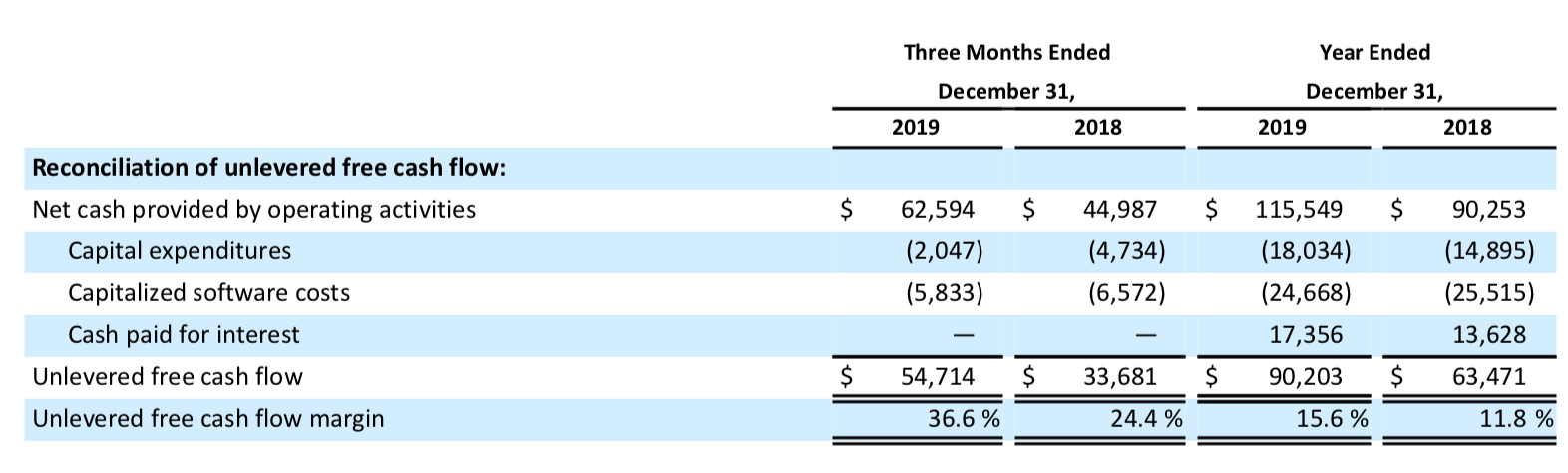

Unlevered free cash flow (ufcf) is the cash flow available to all providers of capital, including debt, equity, and hybrid capital. Free cash flow to equity (fcfe) concept. Unlevered free cash flow $ 81,467 $ 57,571 total revenue $ 338,853 $ 250,438 unlevered free cash flow margin:

Based on whether an unlevered or levered cash flow metric is used, the free cash flow yield denotes how much cash flow that the represented investor group(s) are collectively entitled to. Free cash flow margin is a ratio in which fcf is the numerator and sales is the denominator. Unlevered free cash flow is also referred to as ufcf, free cash flow to the firm, and ffcf.

A levered dcf projects fcf after interest expense (debt) and interest income (cash) while an unlevered dcf projects fcf before the impact on debt and cash. Unlevered free cash flow (also known as free cash flow to the firm or fcff for short) is a theoretical cash flow figure for a business. Essentially, this number represents a company’s financial status if they were to have no debts.

The levered cash flows measure the net earnings of the company. Apple annual free cash flow for 2019 was $58.896b, a 8.15% decline from 2018. Unlevered free cash flow, 1 yr growth % =iq_ufcf_1yr_ann_growth peg ratio iq_peg_fwd holder total shares = iq_holder_shares dividend per share, 1 yr growth % =iq_dps_1yr_ann_growth p/forward cfps iq_price_cfps_fwd mutal fund name = iq_holder_fund_name

The main focus of the unlevered cash flows is the operating earnings of the company, represented by the operating earnings or margins. It is important to note that even if a company is profitable from a net income perspective and positive from an unlevered free cash flow. The company defines adjusted ebitda margin as adjusted ebitda divided by revenue.

On an unlevered basis, or on a levered basis. We consider unlevered free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in our business, making strategic acquisitions, and strengthening the balance sheet. In our previous post, we discussed the meaning and calculation of free cash flow to firm, which is often referred to as “unlevered” free cash flow.

While unlevered free cash flows refer to the cash flows generated by the company without considering its financing structure, levered free cash flows are impacted by the amount of financial debt used. We call it an unlevered free cash flow because it is measured before any debt payments, i.e., interest payments. There are two ways of projecting a company’s free cash flow (fcf):

Estimating Rowan Companies Plc Nyse Rdc Free Cash Flows And Intrinsic Value - The Bankers Tribune

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow - Definition Examples Formula

Unlevered Free Cash Flow - Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Formula - Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Cornerstone Ondemand Its Now About The Cash Flow Nasdaqcsod Seeking Alpha

Unlevered Free Cash Flow - Definition Examples Formula

Free Cash Flow To Firm Fcff - Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Understanding Levered Vs Unlevered Free Cash Flow

Free Cash Flow To Firm Fcff - Formulas Definition Example

You have just read the article entitled Unlevered Free Cash Flow Margin. You can also bookmark this page with the URL : https://naomijez.blogspot.com/2022/02/unlevered-free-cash-flow-margin.html

0 Response to "Unlevered Free Cash Flow Margin"

Post a Comment